By Abdighani Hirad

I. Summary

On March 25, 2020, Somalia has taken the necessary steps and reached the Decision Point and would begin receiving debt relief under the Enhanced Highly Indebted Poor Country (HIPC) Initiative. The Federal Government of Somalia (FGS) received congratulatory notes from the International Monetary Fund (IMF) and the World Bank (WB). Subsequently, on March 31, 2020, the Paris Club[1] creditors agreed to cancel $1.4 billion of debt owed by Somali.[2] Finally, on March 31, 2020, Somalia became the 182nd member of the Multilateral Investment Guarantee Agency (MIGA), the WB’s political risk insurance arm, which is a key part of accessing international private investment capital.

This is a demonstration of the resilience of the Somali nation, and although the current Federal Government of Somalia (FGS) should be congratulated, prior FGS who have contributed to this achievement should also be commended. This process goes back to President Abdiqasim Salad Hassan and Prime Minister Ali Khalif Galayr Administration and the current Administration has done tremendous work in bringing the process to the Decision Point. Future FGS Administration will take to the Completion Point—the home stretch.

This article gives a summary of Somalia’s journey to the Decision Point and Completion Point. It also examines the benefits of this HIPC Initiative on prior countries who have reached the Completion Point and what it portends for Somalia. The empirical evidence from prior countries of this Initiative suggests that it has both short-run and long-run benefits. The evidence shows that after reaching the Completion Point, prior countries experienced:

- Increased capital investment in the short and the long run.

- School enrollment has increased both the short and long run and this is a key for Somalia as an educated population will lead to increased human capital.

- GDP per capita growth increased in the period between the decision point and the completion point, and higher increases were observed after the completion point.

- Debt relief is superior to other forms of aids and can usher in new development and investment for Somalia.

All these benefits will allow Somalia to continue its journey to stability and growth after 30 years outside the international financial system and the immediate normalization of its ties with the international community will reopen access to vital additional financial capital to improve the economy, contribute to improving social conditions, lift millions of people out of poverty and build sustainable development for Somali people.

More importantly, current FGS and subsequent FGS must show good governance with transparency, accountability, and free of the deeply rooted corruption that has plagued Somalia in all previous administrations.

II. Somali’s Journey to Decision Point and Completion Point under HIPC Initiative

a. Reaching the HIPC Decision Point

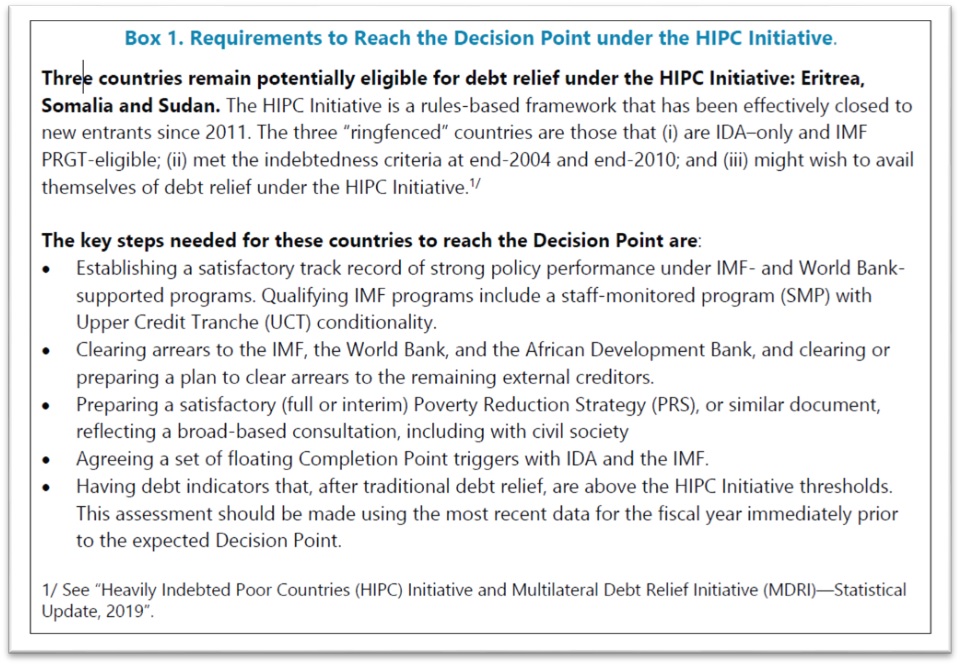

As was announced in a press release on March 25, 2020, the IMF and WB’s International Development Association (IDA) have determined that Somalia has taken the necessary steps to begin receiving debt relief under the HIPC Initiative. Somalia is the 37th country to reach this milestone, known as the HIPC Decision Point. The following table lays out the requirement to reach the HIPC Decision Point under the HIPC Initiative[3]:

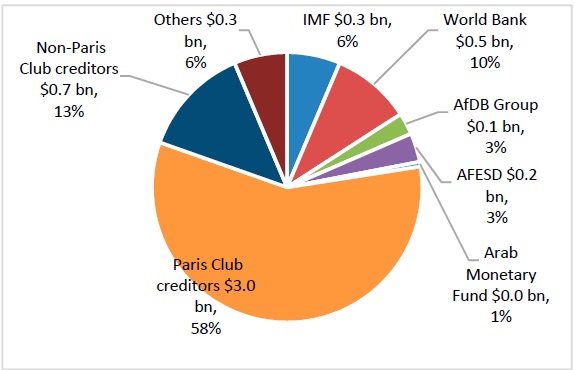

Before going into details of Somalia’s journey in reaching the Decision Point, a brief overview of Somalia’s debt. Somalia’s debt is owed to multilateral (WB, IMF, AfDB Group, AMF, and others) creditors and bilateral (the Paris Club and others) creditors. The multilateral creditors account for 29 percent of the total debt stock in nominal terms, with liabilities to IDA, IMF, and the AfDB constituting 18.5 percent of total external debt. The majority (58 percent) of Somalia’s debt is owed to the Paris Club creditors, with the United States, Russia, and Italy as the major creditors. As the IMF Country Report No. 20/86 reports, “[a]s the of end-2018, about 95.8 percent of Somalia’s external debt was in arrears[1] which is not surprising given that the country has been accumulating arrears since 1991. The following chart shows the composition of external debt as the end of 2018, with the largest percentage (58%) owed to Paris Club, followed by Non-Paris Club (13%), WB (10%), and IMF (6%).

Figure 2: External Debt Stock as of 2018; Source: Somali authorities, IMF Country Report No. 20/86 and WB

Somalia was grandfathered into the HIPC Initiative in 2006 and in order to pave the way for reaching the HIPC Decision Point, Somalia and international organizations have been working on a set of economic policy reforms as laid out in Figure 3 below. Prominent of these reforms are Central Bank Act in 2012, IMF and WB reengagement, Financial Government Committee (FGC), AMF/CFT Act, and four Staff Monitored Programs (SMP) with the IMF. Although these reforms are laudable, Somalia remains a country mired in corruption, “weak security, political tensions, particularly between FGS and FMS and surrounding the upcoming national elections, and vulnerability to climate shocks” (IMF Country Report No. 20/86).

Read the full article: Somalia’s Journey to Debt Relief Under HIPC Initiative

Abdighani Hirad

Email: [email protected]

—————

Abdighani Hirad is a financial risk professional with more than 20 years of experience in financial compliance, evaluation, and monitoring in banking and financial institutions. He holds a B.S. in Economics and an M.S. in Statistics from George Mason University, Virginia, USA.

We welcome the submission of all articles for possible publication on WardheerNews.com. WardheerNews will only consider articles sent exclusively. Please email your article today . Opinions expressed in this article are those of the author and do not necessarily reflect the views of WardheerNews.

WardheerNew’s tolerance platform is engaging with diversity of opinion, political ideology and self-expression. Tolerance is a necessary ingredient for creativity and civility.Tolerance fuels tenacity and audacity.

WardheerNews waxay tixgelin gaara siinaysaa maqaaladaha sida gaarka ah loogu soo diro ee aan lagu daabicin goobo kale. Maqaalkani wuxuu ka turjumayaa aragtida Qoraaga loomana fasiran karo tan WardheerNews.

Copyright © 2024 WardheerNews, All rights reserved