By Liban Farah

Prime Minister Hassan Ali Khayre in his address to the General Assembly of the United Nations on 22 September 2017 made the following statement:

“We will continue to formulate measures to strengthen Somalia’s progress including in revenue generation, however, there are some serious challenges beyond the control of the Somali government. Debt relief would have the effect of unlocking concessional financing, attracting foreign investment and providing an opportunity that is critical to sustaining our reform efforts and consequently reinvigorate our economy.”

Reviewing the 2017 Budget Proclamation of the Federal Government of Somalia, however, deals a big blow to the prime minister’s credibility in reducing Somalia’s economic challenges to lack of government revenues and investment ensuing from its inability to borrow.

We’ll make here a brief independent overview of the government budget in order to assess what it means for future investment and general prosperity of the country.

Budget

I won’t bore you with the specific details and budgetary appropriation for various government departments, because there’s no end to its inappropriate priorities and systematic mismanagement of resources. Suffice to note that Somalia has one of the lowest budgets in the world; indeed the lowest of any country worthy of that epithet and by any account, this budget would make an embarrassing reading to anyone.

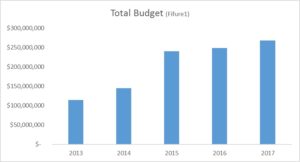

More worrying than the size of the budget is the little prospect of seeing any significant progress judging by its current trajectory of what we have witnessed over the past five years (figure 1).

Average annual budget since 2013 was $203 million – representing 55% domestic revenues and 45% donor funding over that period (figure 2), with projected $19.2 million net increase year-on-year over previous budget. This corresponds to 6% growth of domestic revenues, but even accounting for potential windfalls from air navigation charges following a transfer of Somali airspace control, it will still not be enough to absorb $5.8 million reduction in donor funding whilst at the same time boosting domestic revenues by $25 million. There will be a gap between planned and realised budget that is highly doubtful whether improving revenue collection efficiencies alone would suffice to fill.

The one caveat we should mention here is that we assume Saudi Arabia, United Arab Emirates will continue supporting Somalia with their direct budgetary contributions as they are, along with Turkey and Norway, top contributing donor funding countries of government budget.

Even though these sums are peanuts from the perspective of government accounts, it’s not by far the biggest shortcoming of 2017 enacted budget. There are numerous other issues, but we will restrict this evaluation to the shocking absence of clear and coherent strategy, policy formulation or a tangible economic philosophy that this government aspires to achieve.

Let’s take a closer look at few examples of what that exactly entails, before concluding our observations on how we see this will impact on the country’s future.

Currency

The budget is denominated in US dollar instead of national currency! By failing to adequately prioritise tools for a fiscal and monetary policy options, and by simultaneously conflating currency reforms with a very narrow definition of just printing money to replace counterfeit notes, consecutive governments have committed and continue to commit blunders of immense epic proportions.

Somali government has, by choice or by ignorance, denied itself the possibilities of running current account deficits. That seems to be amusing given that one of the most important privileges of sovereign governments is the ability issue their own currency; a legal tender which allows governments to manage its fiscal operations. We fault the government for its misconceived belief that it has to borrow or obtain “concessional finance” to increase its budget and attract investment as the Prime Minister has said. But issuing nonconvertible national currency is nothing more that IOUs, which in itself is technically another form of borrowing!

Tax

It’s clear from the “revenue generation” mantra that that this government dogmatically believes that it has to tax first in order to spend. This is an article of faith with no basis whatsoever! In fact, a government has to spend first (create money) in order to tax (generate revenues from economic activities of its spending). It comes down to initially running significant deficits, which is then incrementally recovered by taxing. Whenever the economy is severely under capacity as is ours at the moment, it invariably necessitates spending by the government to expand the tax base, by which at the same time through economic activity (multiplier effects) will favourably raise tax revenues consistent with standard arithmetic progression.

Ignoring these possibilities and blindly following the dictum of multilateral agencies, at the expense of potentially being in a position to build schools and staff hospitals, is no different to sadistically inflicting children and vulnerable Somalis with avoidable suffering. Because you are imposing constrains that any sovereign government need not be handicapped with, you are essentially depriving the government of its ability to spend and improve the quality of live conditions for its citizenry. Yes, there could be theoretical restrictions in the sense that inflationary pressures needs to be managed, but there are plenty of straightforward counter measures that can be used to address such risks.

Read more: Is Somalia really a rising nation?

Liban Farah

Contact: Liban.farah@barkinka.com

Leave a Reply